In the basic economic theory of supply and demand, prices rise when there are more people wanting to buy than there is capacity for sellers to sell. Likewise, when there is a glut of product available prices fall to entice more buyers.

In the basic economic theory of supply and demand, prices rise when there are more people wanting to buy than there is capacity for sellers to sell. Likewise, when there is a glut of product available prices fall to entice more buyers.

So much for theory. How does this apply to oil?

The world's demand for oil is not subject to such simple laws.

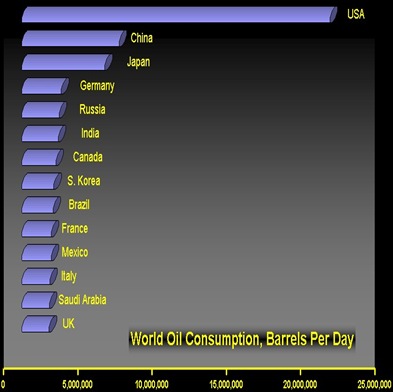

Despite the USA's dominance in world consumption, growth in demand in China and India particularly over the last decade has surged. It must be said that much of this increased consumption is simply from the displacement of industry from the west to the east; as factories close in Birmingham and open in Guangzhou, the requirement for oil to fuel production and transport moves too. But the increased opulence and rapid move to a more capitalist culture in the Indian subcontinent and the Far East have also accelerated local demand for oil too. Meanwhile, the West remains largely reliant on its familiar fuel sources and, while prices have been relatively low, disinterested in reducing consumption.

The USA's fixation with gas-guzzling automobiles, and the European addiction to cheap air travel have also taken their toll. Demand continues to rise all over the world.

Supply kept pace with consumption for the best part of the last century, but in the last decade and especially in the last 2-3 years the supply has failed to meet demand. That is one fundamental reason why oil prices have risen.

So why has supply not risen? And what else is influencing prices?

Around two thirds of the world's oil supplies are dictated by OPEC. This organisation's sole purpose is to deny the market place the ability to set prices according to 'free' supply and demand principles. It is a cartel - yes, the sort of thing that governments try to ban within their own borders - but it operates unashamedly to protect the interests of its members. Its members agree to raise or reduce oil production levels, thereby controlling supply. As demand is inflexible within economies based upon oil consumption, the only release for the mismatch is for prices to rise. And when they do, the oil producers' profits rise with them.

There is the argument that the more oil we extract from the earth, the harder it is to get more. So the exploration, extraction and production costs rise and therefore the oil producers do have some justification for lifting prices in order to pay for this. They might also be forgiven for restricting supply of a scarce commodity in order to prolong the time over which they may enjoy the income from selling it. Many of the OPEC countries' sole or main income is from oil. When it runs out they will have nothing left to replace it.

But the secrecy over which the oil producers treat their planning and their insistence that supply is sufficient to meet demand leaves many to conclude that their motives are profit driven. Put simply, they are greedy and cannot resist taking advantage of a captive world market.

There has been a lot of talk in recent months about the effect that market speculators are having on oil prices. Speculators buy contracts today in order to sell them for more tomorrow in a rising market (or sell contracts they don't own today hoping to buy them for less tomorrow in a falling market).

The weakness of the dollar means that investors are looking for places to make money. Betting on the dollar when US inflation and unemployment are on the rise looks like a bad bet, so oil is getting more attention than ever before. And with the lack of transparency over potential future oil field discoveries, reserves held by both producers and consumers, the rising demand trends and the lack of alternative energy sources, oil prices have only one direction to take.

Oil is not going to be cheaper any time soon, and the world (most especially the West) has left it woefully late to find those alternatives.

Time to dust off the bicycle, oil the chain and leave the car in the garage.

No comments:

Post a Comment